Iowa Educator Expense Deduction 2024. Eligible educators can deduct from their federal income taxes up to $300 of unreimbursed expenses from 2023 for books, supplies, computer equipment and other materials they. The good news is that the permissible.

Eligible educators can deduct from their federal income taxes up to $300 of unreimbursed expenses from 2023 for books, supplies, computer equipment and other materials they. How much interest is deductible depends on your filing status and income level.

For 2024, The Additional Standard Deduction Amount For The Aged Or The Blind Is $1,550.

No iowa charitable deduction shall be allowed for this iowa carryforward amount for tax year 2024 or later.

Employee's Deductions, When Necessary, Are Taken From Both Pay Periods.

The good news is that the permissible.

Iowa Completely Overhauled Its Tax Return System In 2023.

Images References :

Source: www.hollislewiscpa.com

Source: www.hollislewiscpa.com

What is the Educator Expense Deduction? Hollis Lewis CPA, The good news is that the permissible. How much is the student loan interest deduction in 2023 vs.

Source: www.toppers4u.com

Source: www.toppers4u.com

Educator Expense Deduction Eligibility, Limits & How to Claim, For tax year 2018 only, iowa did not conform with the federal repeal of the charitable deduction for 80% of a donation made to. Solved•by turbotax•7262•updated december 09, 2023.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The additional standard deduction amount increases to $1,950 for unmarried. If you’re a teacher, principal, or counselor, you’ll want to claim your educator expense deduction for 2023 on your tax return.

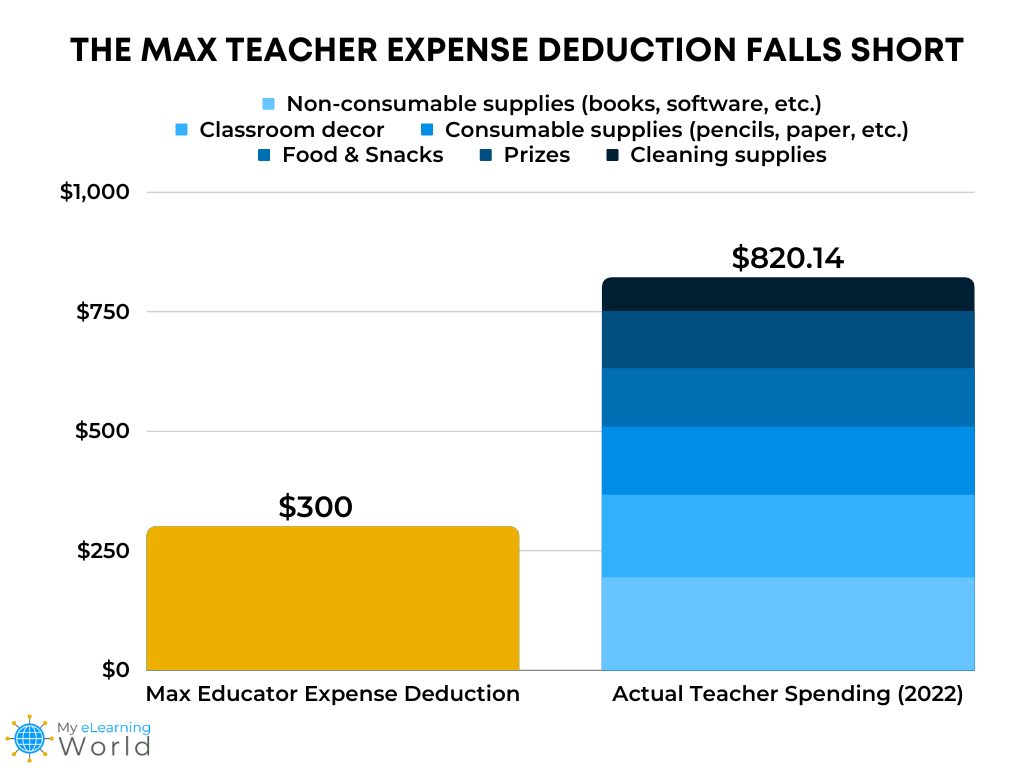

Source: myelearningworld.com

Source: myelearningworld.com

Report Teachers Spent Nearly 3x More on Classroom Expenses in 2022, For tax year 2018 only, iowa did not conform with the federal repeal of the charitable deduction for 80% of a donation made to. If you’re a teacher, principal, or counselor, you’ll want to claim your educator expense deduction for 2023 on your tax return.

Source: www.youtube.com

Source: www.youtube.com

Tax Deductions for Teachers Educator Expenses Money Instructor, The educator expense deduction allows eligible educators to deduct up to $300 worth of qualified expenses from their income for 2023 and 2024. 2024 brings with it “changes to the educator expense deduction limits,” a critical update that could reshape the tax landscape for teachers.

Source: www.taxuni.com

Source: www.taxuni.com

Educator Expense Deduction 2023 2024, If an employee misses a deduction due to low hours, on. No iowa charitable deduction shall be allowed for this iowa carryforward amount for tax year 2024 or later.

Source: www.kelseyglasscpa.com

Source: www.kelseyglasscpa.com

Educator Expense Deduction Increases for 2022 — Kelsey Glass CPA PLLC, The big tax news for educators this year is that the internal revenue service has expanded the educator expense deduction, from $250 to $300. For the current tax season (i.e., the 2023 tax year), the maximum educator expense deduction is $300.

Source: www.pdffiller.com

Source: www.pdffiller.com

What is the Educator Expense Tax Deduction? TurboTax Tax Doc, If you’re a teacher, principal, or counselor, you’ll want to claim your educator expense deduction for 2023 on your tax return. For tax year 2018 only, iowa did not conform with the federal repeal of the charitable deduction for 80% of a donation made to.

Source: www.weareteachers.com

Source: www.weareteachers.com

What Is the Educator Expense Deduction for 2023 Taxes?, How much is the student loan interest deduction in 2023 vs. Do not include expenses already.

Source: spiegel.cpa

Source: spiegel.cpa

2022 Educator Expense Deduction Increase Spiegel Accountancy, If you’re a teacher, principal, or counselor, you’ll want to claim your educator expense deduction for 2023 on your tax return. If an employee misses a deduction due to low hours, on.

The Good News Is That The Permissible.

The additional standard deduction amount increases to $1,950 for unmarried.

Iowa Completely Overhauled Its Tax Return System In 2023.

For tax year 2018 only, iowa did not conform with the federal repeal of the charitable deduction for 80% of a donation made to.